29 Jul How can i get good ?200 financing directly from a lender?

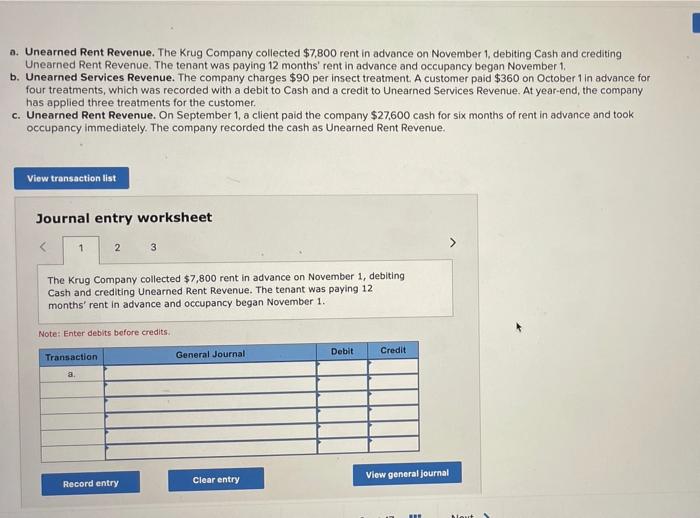

We usually do not need make any guarantees, however, sure, possibly. I cant say to own specific, but when you meet up with the less than requirements, you're permitted acquire ?2 hundred out-of a direct bank:

- You are over 18

- You are a great British resident which have a permanent target

- Youre employed as well as have a frequent earnings

- Have a good Uk family savings that have an effective debit cards

- Your wages is actually paid down to your United kingdom bank account

- You're not currently bankrupt

When examining your application, we're going to make certain you meet up with the very first requirements having credit. However, its vital that you know that if we possess coordinated your having a loan provider, the application might possibly be introduced on to her or him, and they will find more info to determine qualification.

Generally, a lender need to see the following the data files to ensure that you qualify when making an application for good two hundred mortgage:

- Proof of income and expenditure

- Address history comprising a specific amount of decades

- Proof a position

In the event that youre looking to borrow a 200 pound loan now, there have been two methods for you to go about that it. You may either check out the 200 lb financing head lenders webpages and apply there.