05 Jul Alterra Home loans Remark 2022: Suits Underrepresented Borrowers With Option Underwriting Choices, but Costs and you will Charges Not Listed On line

Alterra Mortgage brokers targets lending so you can underserved organizations when you look at the 34 claims plus Arizona, D.C. That it financial could help you rating a loan when you’re a primary-day homebuyer, try thinking-operating, inhabit children which have numerous sourced elements of income, need help having a down-payment, otherwise run out of a social Safeguards amount, or require a spanish-speaking mortgage administrator.

Editorial Independence

Just like any of our own lending company recommendations, all of our analysis isnt influenced by any partnerships or ads relationships. To learn more regarding the the rating methodology, click on this link.

Alterra Mortgage brokers Full Feedback

Alterra Lenders was a lending company that has been established in 2006 and that’s today element of Views Financial Class. Brand new Las vegas-based bank offers different loan products for many types away from individuals, also individuals who are care about-operating, need assistance making use of their advance payment, otherwise has actually money of numerous offer.

Because the a 100% Hispanic-owned providers, Alterra’s objective declaration states it aims to simply help underrepresented resident organizations. The company states 73% of their consumers was in fact diverse and you can 62% was basically first-date consumers within the 2019. Some of the lender’s financing officers are fluent in English and Language, which will help multilingual consumers navigate new homebuying process.

Alterra Mortgage brokers: Mortgage loan Designs and you can Circumstances

Alterra Mortgage brokers now offers mortgages to have consumers thinking of buying, renovate, otherwise refinance a property. On the lender’s selection nowadays:

Alterra can also help consumers thanks to some other homebuying obstacles, as well. As an example, the company’s underwriting design caters consumers who will be care about-working or who live within the houses where numerous household members lead towards monthly obligations.

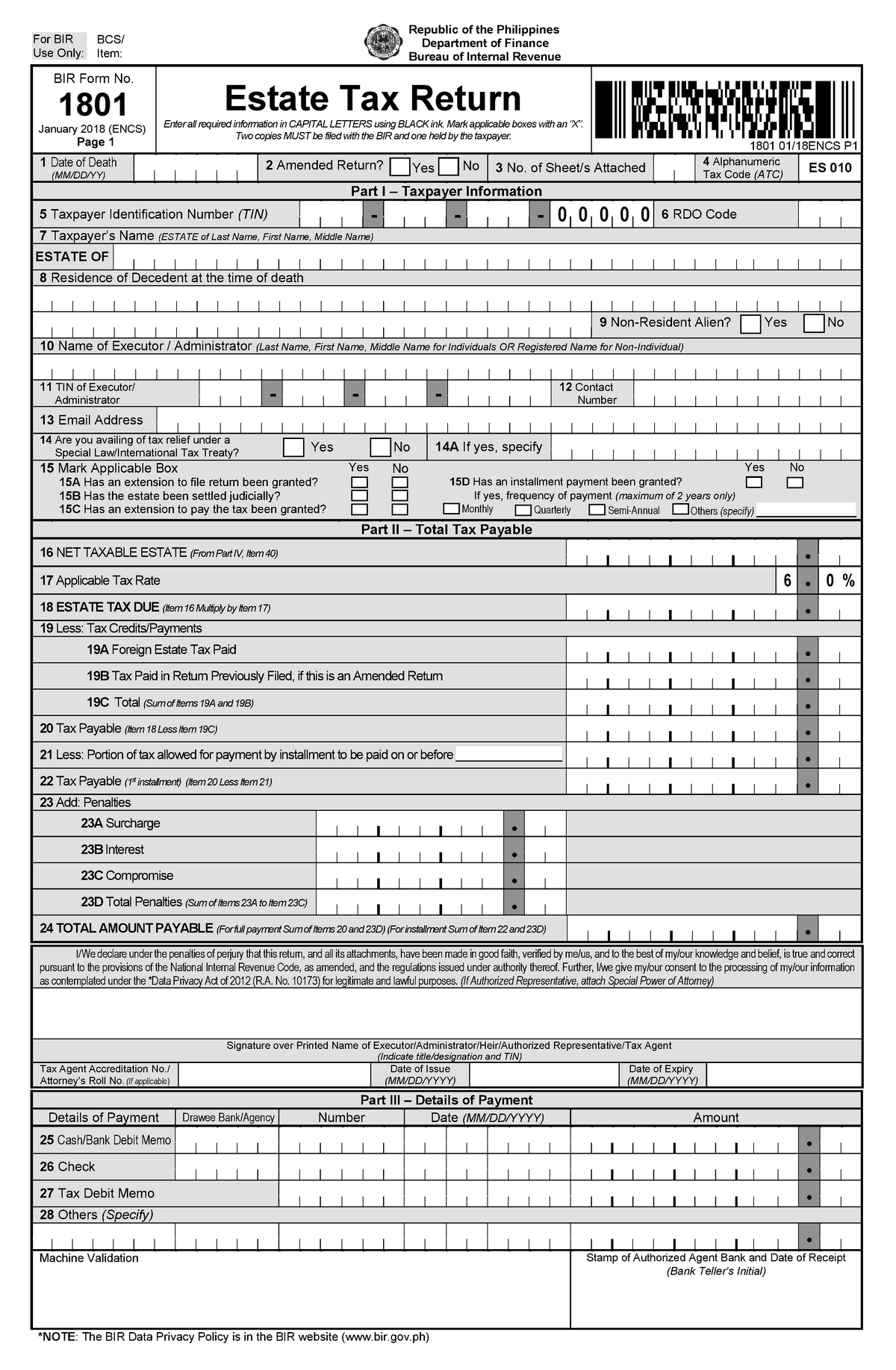

The financial institution also offers a foreign national loan program where borrowers can use one taxpayer character number (ITIN) as opposed to a personal Safeguards amount. In order to be considered, consumers should provide an excellent 20% down-payment, reveal one or two years’ worth of a position in the same type of works, and offer their several current taxation statements with the ITIN. These lenders come having a high rate of interest.

Alterra Lenders: Openness

Alterra Family Loans’ webpages doesn’t advertise home loan prices or bank charge and offers hardly any information regarding its choices. Users won’t look for factual statements about the types of finance Alterra offers, information regarding certification criteria, or beneficial tips about the financial techniques.

Borrowers is submit an internet setting in order to request a phone telephone call out-of that loan administrator otherwise they may be able go to certainly the new lender’s into the-individual part offices. I tried getting in touch with the lender from time to time and you may did not apply to someone, but i did discover a call-straight back off that loan administrator just after filling in the internet means. The brand new associate gave facts about the borrowed funds techniques and you will provided an effective price price instead a difficult borrowing eliminate.

If you opt to fill in a mortgage software, you can submit you to definitely on the internet otherwise through the lender’s mobile app, Pronto Along with. Financing manager tend to contact that set-up an account and you can complete the loan acceptance techniques. You might track the job, publish documents, indication papers electronically, and you will ensure the employment on line.

Alterra Home loans: Financial Pricing and you may Costs

Alterra Lenders doesn’t encourage rates towards the its web site otherwise provide a summary of fees borrowers you will spend on closure. However, it ong extremely loan providers. You may spend in the dos% so you can 5% of your residence’s total price within the fees, plus bank charges and you will and you will third-team will set you back. Costs consist of:

- App and/or origination fee commission

- Credit report charge (optional) prepaid can cost you

- Bodies taxes

- Recording fees

Financing eligibility on Alterra may differ with each financial program. To help you be eligible for a conventional mortgage flex loan with bad credit, individuals you prefer a credit rating with a minimum of 620 and you can an excellent lowest downpayment of step 3%. However with FHA financing, consumers need a credit history out-of merely 580 with a lower fee with a minimum of step 3.5%. Alterra also means a rating with a minimum of 580 discover an effective Virtual assistant financing, you won’t need a deposit.

Refinancing With Alterra Lenders

Home owners which have a preexisting mortgage is able to save money or borrow funds that have a refinance loan. Alterra’s website will not render much facts about the fresh new re-finance procedure or bring resources and rates, very you will have to get in touch with a loan manager for more information. Alterra offers:

, which allow you to get yet another interest rate, mortgage label, otherwise one another. Home owners have a tendency to make use of this brand of financing to save cash, treat private mortgage insurance coverage, or switch away from a variable-rate financial to help you a fixed-price loan. , which permit you to borrow money with your home equity once the guarantee. You might pull out a mortgage for over you borrowed, pay off your current mortgage, then deal with the real difference inside the bucks.

Sin comentarios